[This is the sixteenth entry of 18 in a game design journal series introducing Spheres & Farms™, a game about real estate brokerage branding in the Puget Sound region. Previous | Next]

Multifamily projects comprise high-rise tower projects and low-rise projects. Single-family projects comprise subdivision projects. (In the game, no distinction is made between low-rise multifamily projects, townhouse subdivision projects, and single-family subdivision projects. These are all treated as "low-rise/subdivision” projects and sales.)

The original concept of Spheres & Farms™ centered on retail sales, not projects or presales. Improvisation of project listing phases and their components into the design was prompted by the following: first, a major initiative of my hosting brokerage in 2018 to draw condominium tower listing contracts as key accounts to feed listings to the brokerage’s agents; and second, the high placement of project listing agents among the ranks of brokers by selling transactions. As a rule, project selling agents list and close larger numbers of properties than their colleagues who work as retail listing agents.

The challenge to introducing projects and presales to a model built to simulate the retail listing and selling business is that the game’s objective remains brand visibility, not strictly accumulation of sales. There is no way to accommodate the volume of listings from a single project on any location card. That would be pointless in any case, as in game terms, the purpose of the retail listings from the brokerage’s viewpoint is to signal the brand’s presence and value at a specific location. This can be done as easily with a handful of high-profile listings as with a hundred or more at the same address.

The potential volume of sold project listings exerts a much greater influence on the brokerage’s bottom line through commission income. This can be reflected by far higher P&CR point gains from project phase sales. To a realty brand, the real-world benefit of this income is that the surplus can be redirected into agent recruitment and brand promotions in other areas and locations prioritized by the brand. Brokerages and their offices need to weigh this benefit against the higher risks of long-duration projects during times of economic uncertainty.

Contingent on the current economic cycle phase, project listing opportunities arise in result of an event indicated on a drawn prospecting card. Single-family subdivision projects may be opened only in “R” (suburban residential) neighborhoods. If the drawing player has an agent with a farm on the Homebuilders box among the marketing spheres on the combined records mat, the player may open a subdivision project, assigning that agent as the project listing agent and opening the project in any R-density location in which that office has recently sold listings.

Otherwise, the player receiving a new project event may draw a new project listing agent from among eligible project listing brokers remaining in the agent pool, and open the project as either a high-rise tower project in an “H” (urban high-rise) neighborhood, or as a mid-rise or low-rise project in a “U” (urban higher density residential) neighborhood. No project may be opened in an “E” (exurban) neighborhood, and no subdivision project may be opened if the player doesn't have an agent's farm in the Homebuilders box and follows the opening procedure for that project as described above. Also, no more than two projects may be in progress for any office at any time.

Within these limitations, the player may assign the new high-rise, low-rise, or subdivision project to any area in which they have recent sold listings. The simulated assumption is that the managing broker has been soliciting new project listing opportunities in that area which have now borne fruit. The project listing agent and up to two other agents may be assigned to this project. No agent assigned to a project is assumed to be geographic farming. As will be explained below, success of the project depends on agents having active farms in two or more marketing spheres not counting either the Geographic Farming box or the Homebuilders sphere box (the latter of which may have been used to generate a subdivision opportunity, but not project phase sales). Any agent assigned to a project is transferred from the brokerage mat to the project mat [draft playtest version to be added to this journal entry when complete]. Their farms are to be left in place.

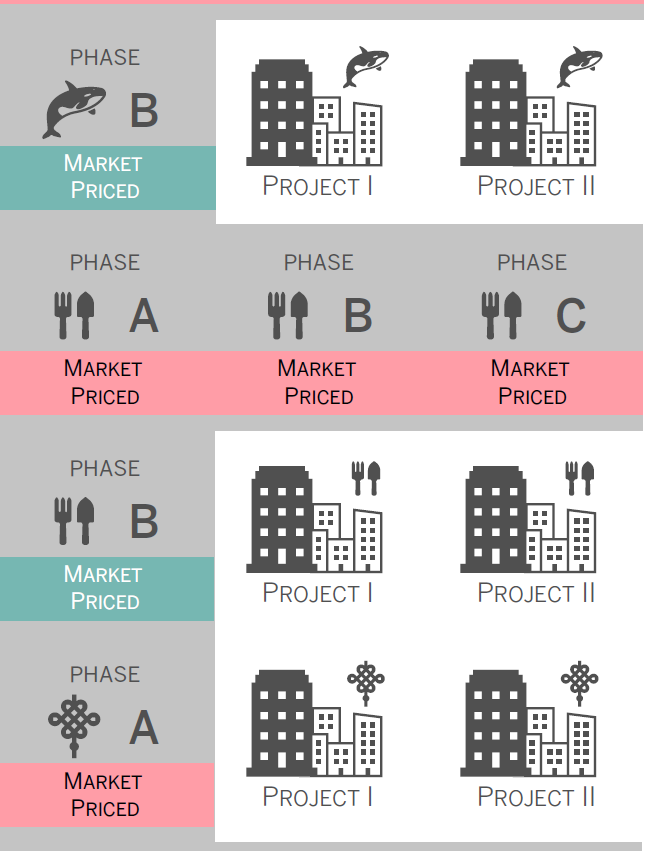

Project phases

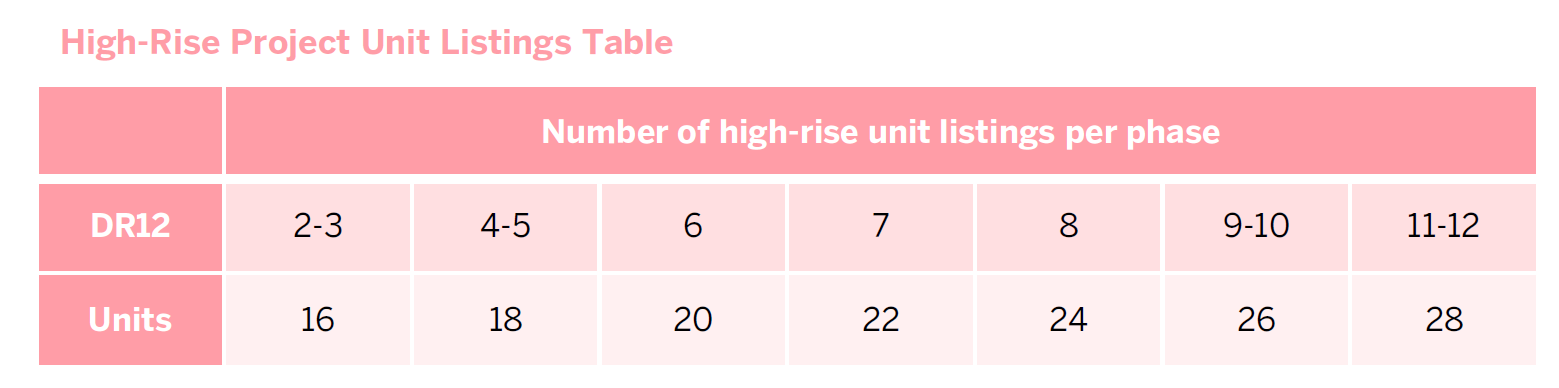

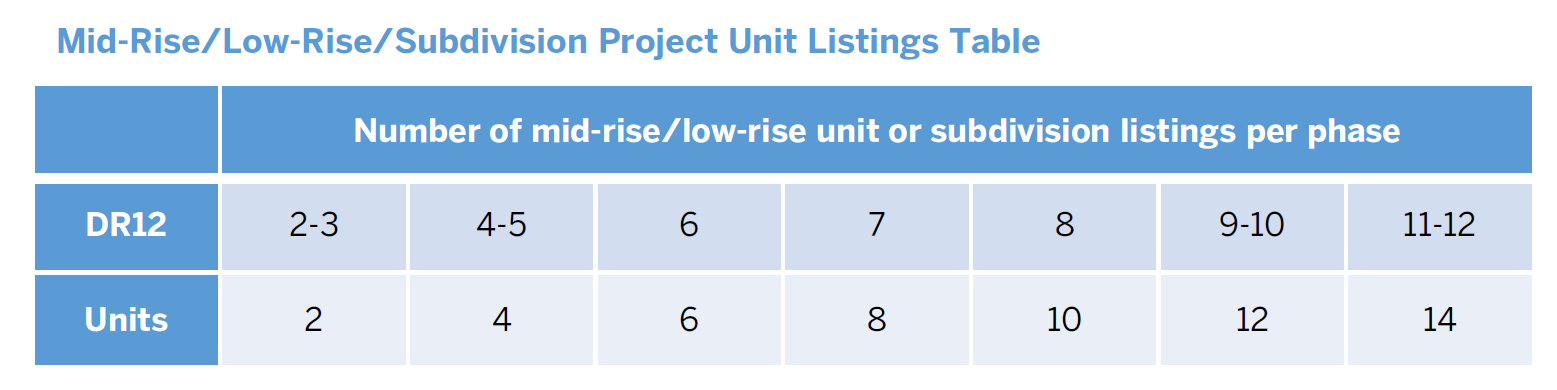

The player next sets up the new project on their project mat. Each project is opened to presales in three phases. To determine the number of listings per phase, the player rolls on either the high-rise listings table for a tower project, or the low-rise/subdivision listings table for any other project.

The results indicated on the project listings table will indicate how many listings will be offered in each phase. (Bear in mind that these unit numbers are notional, not precise; they are only meant to lend a measure of the proportions of these project phase listings to the equally notional numbers of retail listings, which stand for one to five listings each.)

The "Project Construction" counter is then set at the current turn space on the combined records track. The "Project Occupancy" counter is placed 10 turns later (equivalent to two years in real time). The "Phase 1 Presales" counter is placed three turns after the Project Construction counter. When the Phase 1 turn is reached, presales of units begin. The Phase 2 and Phase 3 markers are placed sequentially on the turn following any turn in which the preceding phase's units are completely presold. This means that the earliest a project can be presold is five turns (equivalent to one year) after the project is won. If a project's sales are stalled (i.e., the sales in any phase are not complete by the Project Occupancy turn), the Project Occupancy counter is pushed back by two turns.

Project phase pre-selling events

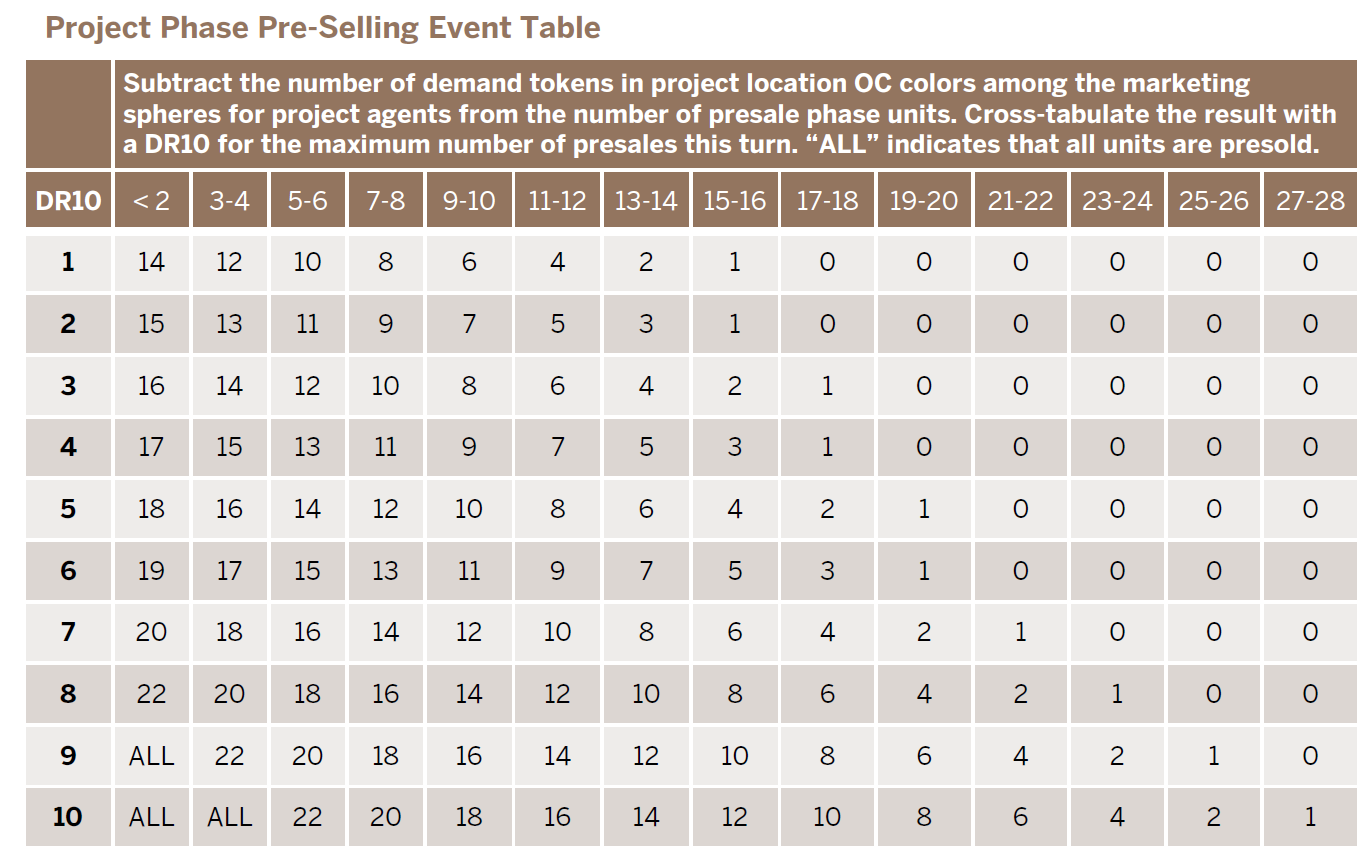

Each project is eligible for one mass selling event each turn at the beginning of the Selling Phase. The sales for these events are rolled on the Project Phase Pre-Selling Event Table. The active player begins by counting the numbers of demand tokens of (a) the relevant OCs for that location among (b) all marketing spheres except Homebuilders and the Geographic Farming Box for (c) all agents for that project on the project mat (i.e., those assigned project listings). None of these demand tokens are to be removed from their boxes to fill project sales. This figure is subtracted from the number of units previously determined on the Project Listing Table. The difference is used to find the relevant column based on the ranges in the top row of the Pre-Selling Event Table. A DR10 is rolled on the leftmost column, with the cross-indexed result indicating the number of units sold. This number is indicated using numbered counters on the project mat.

No VPs for the location card are added to the combined records table (as it has been assumed that the brand is already visible in this location),23 but a number of P&CR points are added equal to a multiple of the 1/10ththe VP value times the number of units sold. The next phase cannot start until the turn after the previous phase’s units have all been presold. When all phases of a project are sold, that project is closed.

23 No successful project developer is going to contract listings to a broker who does not have strong visibility and a track record of sales in the target location. The brokerage has already established visibility at this location and is aiming at the commission income from unit sales.

Schedule of entries

- Spheres & Farms™ design and strategy journal: Introduction

- The agent and brokerage as real estate brands

- How price and place matter

- Visualization, testing, and learning

- Spheres & Farms™ game summary

- Game procedures and routines in the context of agency law and practice

- Game components; agent counters and cards

- Farming methods; market selection

- More about marketing spheres; the economic cycle track (ECT)

- Economic cycle effects on marketing spheres

- Location cards: the Spheres & Farms™ "game map"

- Location card contents, office locations and maintenance

- The prospecting/event card deck

- Prospecting for listings and incurring events

- P&CR points: promoting and selling listings