[This is the fifth entry of 18 in a game design journal series introducing Spheres & Farms™, a game about real estate brokerage branding in the Puget Sound region. Previous | Next]

Before proceeding with presentations of its components, their design rationales, and functions, Spheres & Farms™ needs a few words about its inspiration, and an abstract. Moreover, one pivotal question must be addressed:

Should Spheres & Farms™ be offered as an internal tool or a commercial product?

The game was conceived as a training exercise to “get inside the heads” of the owners of a branded real estate affiliate and their senior staff. The next step was to host a game involving the managing brokers of that brokerage’s regional offices, giving them the chance to “play the owners for a day.” Since this was a leading regional affiliate of an international network brand, it was supposed that a successful rollout might be extended to other affiliates nationwide, customizing components as needed to do so.

The scale of the game presents a rather foreboding obstacle to its viability as a commercial product. With five players, it should be expected to occupy a full-sized conference table. This is after scaling down the game: the original design was to have each player represent a competing brand. This scale did not allow realistic modeling of the listing and selling behavior of individual agents, which is where the action is in the business. Inter-brand competition was therefore discarded in favor of a co-opetitive model, with each player representing the managing broker of an office of the same branded brokerage. The interaction with competing brands has been reasonably abstracted into the prospecting phase: the listing opportunities presented to a player’s prospecting agent may be regarded as those that they have already won against any competitors.

A commercial version of Spheres & Farms™ is certainly possible, and would offer the greatest reach to anyone with an interest in the residential real estate business. However, it will probably require further downward scaling of the game: fewer location cards, and perhaps fewer agents per office. There are other implications of internal vs. commercial applications of the game to be discussed in a later journal entry, “Game components; agent counters and cards.”

Inspiration: brand presence and visibility

After a decade of due diligence assignments in China, I earned my real estate license in 2013 with vague plans to return to the U.S. I hung my license with a Seattle-based affiliate of an international realty brand. My family returned to my hometown of Anacortes, a seacoast tourist magnet midway between Seattle and Vancouver. Within six months of our return, I began to draft analytical reports on contract for my new client to drive their residential real estate business.

About a year later, on an errand to find a rental for a friend, I visited an independent local real estate office in downtown Anacortes. I was surprised to see luxury Seattle and Eastside King County publications on display at their office. This coincided with my observation that many local homes were second homes or rentals owned by non-residents, including King County residents a two-hour drive away.

This meant that a seller in Anacortes benefited from promotion to buyers in King County that would result from employment of a King County broker. That explained why so many high-end residences in town were listed by these out-of-town real estate brokers, even though the geographical distance made it difficult for them to show such properties.

It further explained why a handful of successful real estate brokers in town were employed by brokerages in urban counties to the south. While brokers who didn’t live in town might win some of these exurban listings, those who lived locally were more likely to close sales. Consequently, the out-of-town brokerage brands employing these agents enjoyed as high a profile locally as the locally hosted brokerages, and higher than those metropolitan brokerages who lacked local representation.

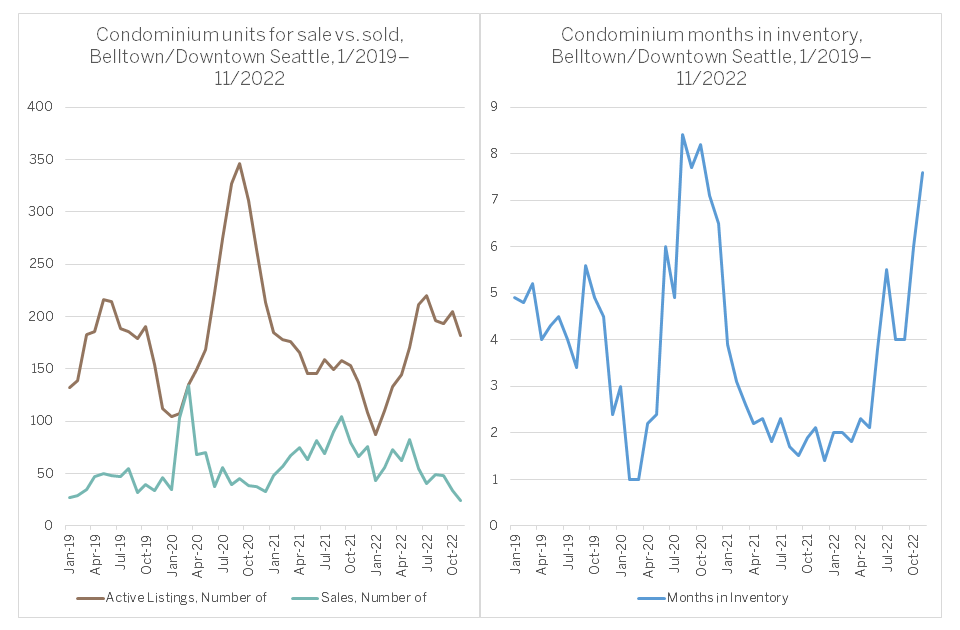

The question of exurban brand presence gained importance during the COVID-19 crisis, as the steady flow of buyers into the exurbs swelled to a flood. Those brands who had already established visibility in the exurbs were immediately able to profit from the new listings and sales at the edges of metropolitan Seattle. Those who had overinvested in the downtown markets saw their business slump over the next two years. Condominium units for sale at The Emerald, Spire, and Koda all saw price cuts.9

With this and the substance of the foregoing journal entries in mind, below is an abstract of the game as currently designed:

Game abstract

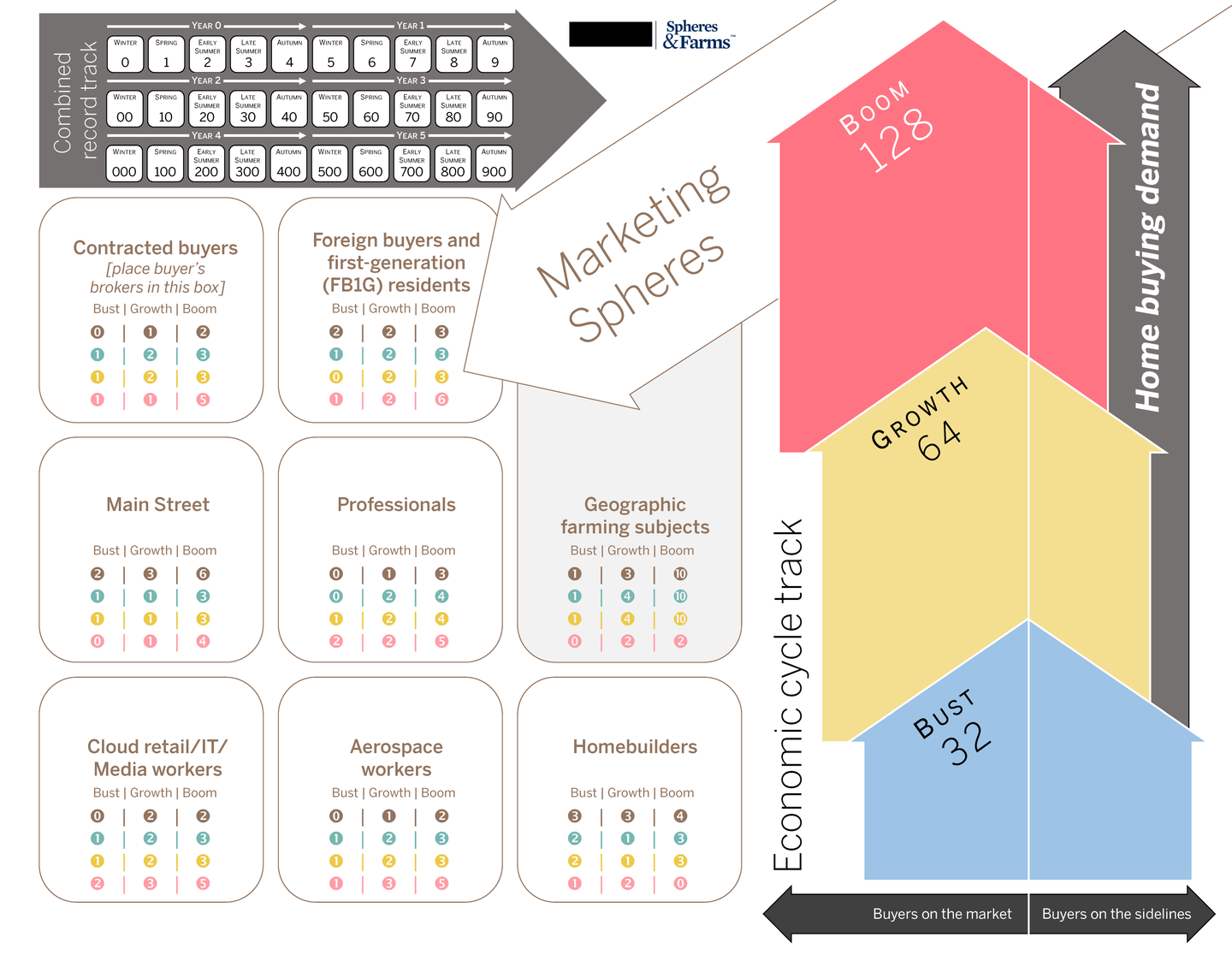

Spheres & Farms™ is a game that simulates the complex and competitive agency relationships and dependencies in a real estate brokerage business. Players seek to build a retail real estate brand through listings, sales, projects, and agent acquisition. Game turns represent one four-month winter turn and four sequential two-month turns over several two-year scenarios and a five-year “campaign.”

High-rise, urban, (urban and suburban) residential, and exurban markets are each represented as single “location cards” with marketable attributes of actual local communities in the Puget Sound region in the 2010s. As listings are added in new locations, new location cards are brought into play, together comprising a “map” of the brand’s expanding presence. Open and closed listings are tracked on the location cards, contributing to brand visibility points, the “currency” of the game. Location cards are valued according to their contribution to brand visibility.

Players represent managing brokers collaboratively advancing the brand’s influence across markets through promotion of markets and listings, agent recruitment, project development, and risk management. Managing brokers only indirectly control agent behavior and activity, which is partly randomized by card plays; marketing spheres, including geographic farming; selling strategies; and changing economic conditions as indicated on the “economic cycle track.” Availability of buyers for listings also varies according to these factors. “Event card” plays introduce contingencies that can be foreseen and occasionally hedged against.

Although resources are limited and must be carefully deployed, Spheres & Farms™ differs from traditional real estate games in that money otherwise plays no part. Property values are abstracted into ordinal categories that relate only to marketing and matching listings to (equally abstract) buyers, not to returns or to winning the game. The objective is to maximize visibility for the brand by recording sales among location cards adding up to meet or exceed a threshold number of visibility points. Victory conditions allow players to win individually, or lose collectively, and are flexible to award victory for successful targeting of any of several types of markets.

9 Heidi Groover, “Prices cut at Seattle's luxury condo towers as housing market cools,” Seattle Times, 24 July 2022.

Schedule of entries

- Spheres & Farms™ design and strategy journal: Introduction

- The agent and brokerage as real estate brands

- How price and place matter

- Visualization, testing, and learning

- Game procedures and routines in the context of agency law and practice

- Game components; agent counters and cards

- Farming methods; market selection

- More about marketing spheres; the economic cycle track (ECT)

- Economic cycle effects on marketing spheres

- Location cards: the Spheres & Farms™ “game map”

- Location card contents, office locations and maintenance

- The prospecting/event card deck

- Prospecting for listings and incurring events

- P&CR points: promoting and selling listings

- Construction projects and pre-sales

- Visibility points: accumulation and scoring

- Sequence of play