This is the first of a series of posts of a “design journal,” introducing and walking readers through a prospective strategy game on premium real estate branding. This series will start with 18 journal entries describing the logic and inspiration of the game and its components, then go on to playtesting outcomes and strategic insights. It will be of special interest to real estate brand owners, other retail brand owners, larger-scale home builders, and game designers, as well as wargamers or grognards interested in new game mechanics and new applications of familiar mechanics. Individual real estate agents will be interested to see how what they do fits into the overall strategy of the brand they represent. The intent is to, as closely as possible, model how brands achieve visibility and dominance in an interconnected web of local markets.

This journal will not only introduce the principal assumptions behind the game, but also the tentative game mechanics designed to simulate the conditions influencing, and procedures for winning, real estate sales and real estate brand eminence. There will not be any code, or any scripts, because this will not be a video game or console game. It will be a face-to-face game, played on a conference table, or other expansive surface.

Most, indeed nearly all real estate games to date are about investing or building, usually from the client’s perspective. The universally popular example is Hasbro’s Monopoly®, credited by former publisher Parker Brothers to Charles Darrow, but whose original design was developed by Georgist Lizzie Magie as The Landlord’s Game. All players in Monopoly® represent investors rather than agents or brokers. It is a game about the real estate investment business and its implications, not about the real estate listing and selling business.

Those few listing- and selling-focused games marketed by real estate coaches are typically contests centered on sales or selling behaviors practiced by the individual agent. These are not really real estate games, but rather comprise generic behavioral sales training of the kind practiced by insurance agents and other sales professionals. These games are training tools and are not intended to impart any knowledge of the real estate business or its strategy, although they may be promoted as such. Some will object to this characterization, but this is not to say that these behaviors are not relevant to success. They are in fact generally accepted selling doctrines that have nothing to do specifically with real estate. Narrowly focused as they are on the routinization of behavior, these games teach tactics, not strategies.

The objective of this game is ubiquity of the brand across a geographic region. The design was prompted by real-world concerns relevant to the Puget Sound real estate market in the mid-2010s, the setting for the game. This was a period when interest rates were generally low—a modest increase of 25 basis points was enough to make news and move the market. This ended with the onset of the COVID-19 crisis in 2020-21. The question during these years was whether intensive targeting of high-end markets and “unicorn listings” that made sense on paper might both interfere with a more balanced approach that would feed more agents, and inhibit a flexible response to changing market conditions. These concerns were later validated by the exurban flight from the Puget Sound region that accelerated under COVID-19 restrictions and the sharp increase in work-from-home policies (WFH).

Most activity in the game centers on these economic conditions as the setting for the reciprocal relationship between agents and a brokerage brand. The agent contracts with the brand to gain recognition and visibility. The branded brokerage delivers promotions, print, advertising, internet, and other media collateral, in addition to the regulatory compliance and training required of any brokerage. Branded affiliates also connect the broker with sister affiliates of that brand for co-marketing and referrals from other states and countries. In exchange, the branded brokerage contracts with its agents to gain the attributes that add client and customer confidence to that visibility, based on successful listings and sales. Succinctly put, the agent sells houses; the branded brokerage sells agent visibility.

An immersive experience of real estate brand-building requires that the economic cycle, the visibility and promotional function of the brand, and the prospecting, listing, and selling activities of agents all be reflected in the game’s design. Due to the high volume and limited control of agent activity in real life, and the game’s focus on office managing brokers as brand trustees, agent behavior needs to be at least partly automated by the game system.

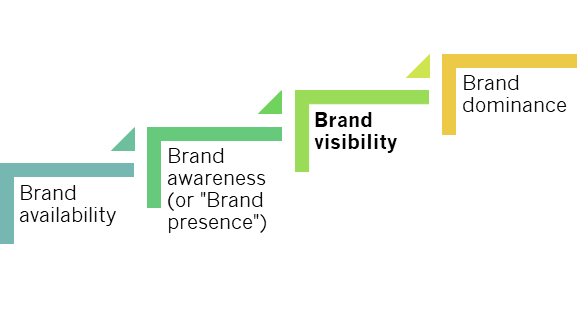

The scope of this game can be better understood by viewing a spectrum of brand influence, and to pinpoint where the focused activities of the game sit on that spectrum. The brand, whose activities are modeled simultaneously by all players, enjoys availability across the map comprising all locations; but its presence is only demonstrated where agents are farming for listings. The objective is brand visibility among those locations of the highest value in game terms. Brand dominance is outside the scope of the game, as this would necessarily require the participation of competing brands. In real estate, this competition is generally limited to the solicitation of listings. Thereafter, agents of different brands collaborate with each other to win sales.

- brand availability — a customer can seek out the brand in this market, but only with effort

- brand awareness or presence — the brand's name and value are recognized by customers, brand influence at the threshold level

- brand visibility — a measurable notion of the brand's presence in the market; high visibility signals equality with top competitors

- brand dominance — the brand's visibility and influence exceed all others in this market

Care should be taken to devise a method of rewarding brand visibility that extends beyond the areas where the most valuable properties are concentrated as measured by selling price. Each player’s objective is to establish the brand’s visibility among a threshold value of key locations, each of whose distinguishing features are to be summarized on a “location card.” The working model devised values locations based on their volume of sold listings relative to adjacent areas. This correctly attributes greater visibility to key outlying markets across the region that balance the urban centers. These suburban and exurban locations both draw listings from and feed buyers back toward those centers. Money plays no part in the game, although successfully closed listings do earn resources available for further prospecting, projects, and promotion of newer listings.

Early drafts of the game design planned for competition among different brokerages in establishing offices and recruiting brokers. While the recruiting aspect survives, the brand competition aspect has been discarded as unworkable in terms of scope and time increments. This is now a cooperative game that rewards individual players, now representing managing brokers rather than brands, if certain goals are met, and punishes all if they are not. This narrowing of the scope allows the model to reflect everyday activities in which all parties to a real estate brokerage brand are engaged in the most realistic way possible.

The question of whether Spheres & Farms™is best-suited as a strategic planning tool for internal use, or as a commercial product, will be explored in a fifth journal entry (“Game summary”).

We begin with a backgrounder on the unique challenges to branding in the real estate business, which will comprise the second and fifth journal entries. In-between these two, some foundational discussion of pricing, visualization, and learning will be desirable. The remaining entries will each present game components, their design rationales, and how they function. The final entry will be an annotated draft sequence of play.

Schedule of entries

- The agent and brokerage as real estate brands

- How price and place matter

- Visualization, testing, and learning

- Spheres & Farms™ game summary

- Game procedures and routines in the context of agency law and practice

- Game components; agent counters and cards

- Farming methods; market selection

- More about marketing spheres; the economic cycle track (ECT)

- Economic cycle effects on marketing spheres

- Location cards: the Spheres & Farms™ “game map”

- Location card contents, office locations and maintenance

- The prospecting/event card deck

- Prospecting for listings and incurring events

- P&CR points: promoting and selling listings

- Construction projects and pre-sales

- Visibility points: accumulation and scoring

- Sequence of play