[This is the twelfth entry of 18 in a game design journal series introducing Spheres & Farms™, a game about real estate brokerage branding in the Puget Sound region. Previous | Next]

The contents of the location cards include identifying information as well as strategic information about their subject locations. The former include place names, location IDs, and photographs. The latter comprise all other information on each card—functional attributes of these locations that generate or condition listing and sales activity, which in turn contribute to brand visibility.

Location ID

The location IDs are artifacts of the original map design effort before the card scheme was devised. They were essential then, because the space on a unitary physical map was too tight to allow the full names of all locations to be printed out, even after distorting the map to make more space in congested areas. The IDs remain desirable for several reasons:

- They allow continued use of a smaller physical map for reference during the game, for such tasks as planning farms and computing maintenance fees by counting the distance from office locations.

- They allow concise references to each card and its data, including for programming purposes should the game be digitized later.

- They allow expansion of the game to include or refer to additional geographic places with similar or identical names.

Location visibility points

The values of locations in game terms are set based on each community’s proportion of sold listings relative to those in adjacent communities. These are better understood as measures of visibility than of the comparative value or overall number of potential listings; hence, we call these values “visibility scores.” Why? Because an agent conducting geographic farming in Anacortes, for example, is not competing with other agents for listing clients in the much larger, more affluent cities of Bellevue and Seattle. That agent is most likely competing for listing clients right there in Anacortes, or in the neighboring towns of Burlington, Mount Vernon, Oak Harbor, or Lopez Island. The likelihood of winning any listing in Anacortes is proportional to the number of potential listings there in proportion to those in these neighboring communities in which that agent is visible.

Location photographs

The photographs are provided to give some sense of the kinds of real estate being sold at each location. They are perhaps one of the features to be affected by any decision to commercialize the game. As long as the game is used as a training device, or as advertising collateral for brokers, the appearance of the photos should be considered fair use under NWMLS rules. Should the game be sold as a commercial product, this use may raise questions, and modifications or substitutes may be required.16

Density types

A taxonomy of locations by density and remoteness is required for two purposes: to set apart those areas where high-rise projects are allowable from those where only single-family projects are possible; and to distinguish those exurban areas where second homes are attractive to urban residents. Two criteria were used to determine whether a community should be classified as “urban” (U) or "residential” (R): among neighborhoods in Seattle, whether it had been designated by the city as an urban village; or anywhere, whether 20 percent or more of all listings there were condominiums. Communities meeting either of these criteria were designated “urban” (U). Others, along with suburbs and larger towns, were labeled R for residential. Communities designated H for “high-rise” included only downtown areas in Seattle and Bellevue. All remote communities were designated E for “exurban.”

The next two attributes reflect aspects of communities that influence who lives there, with implications for exposure to marketing spheres and targeted quality-of-life promotions.

Employment aspects of a community

The proximity of a location card to an employer, indicated by an employment commuting symbol, provides opportunities to agents in that community to shift from a geographic marketing model to a sphere marketing model. That is, agents come into contact with sufficient numbers of employees of these companies to assemble a marketing sphere based on these relationships. Completing the cycle, the marketing sphere thus created allows continued exposure to listings in this location and others where such employees list and purchase properties. Through the event cards, employer concentrations also expose those agents both to opportunities via employer hiring sprees, and risk via employer relocation plans. (Employer relocation is among the contingencies represented by an event card play.)

Leisure-related “amenity symbols”

Like employment commuting symbols, amenity symbols appear on some location cards to indicate opportunities available to agents farming on those cards. Those agents are provided extraordinary listing opportunities by promotions and promotion-related event card plays. On the other hand, they occasionally may subject agents to adverse contingencies involving infrastructure or acts of God, triggered by event card plays.

Location OCs

You have read about the demand aspects of OCs in relation to the economic cycle track in "More about marketing spheres; the economic cycle track (ECT);" and about their representation as demand tokens in "Economic cycle effects on marketing spheres." The gray capsule at the bottom center of each location card indicates local supply that may meet this demand. If during the prospecting phase, a drawn prospecting card indicates one or two of the OCs in the capsule, that means that the agent has a listing opportunity that meets available demand in either the geographic farming box, or in that agent’s farmed demographic among the marketing spheres. If a matching demand token is present, then that agent may open a listing.

The location card OCs roughly align with the price distributions of all listings sold at those locations from 2017 through 2019, in comparison with the quartile bounds for listings sold among all communities represented in the game. This is why no (highest-order) pink OCs are found among any of the exurban location cards. A high-end listing may still appear on exurban Orcas Island through play of the Celebrity Listing event.

Listing dials

When a listing is opened, a numbered listing flag matching the symbol of the office and the agent’s assigned color is placed on one of the listing dials grouped on the location card. Each dial has five points corresponding to the number of turns in a year, beginning with the turn that the listing is opened. Each listing flag is shaped like a triangle to be pointed at “1” upon listing, and advanced at the end of the selling phase before each passing turn, until it reaches “5.” An opportunity to sell the listing is presented during each promotion and selling phase. If the listing is sold, the flag is flipped to the “sold” side, re-set to “1,” and temporarily remains as an indicator of continued visibility of the brokerage brand’s activity at that location. It is tracked again back to “5,” then removed unless replaced with another sold listing flag. Five dials are provided for listings, but only the latest closed sale need remain to mark the card.18

Residents’ recollection of a successful listing and sale does not disappear overnight. The continued visibility of the brand after the sale is closed reflects the presence of “sold” signs, online and printed brokerage ad copy advertising the closed sale, engagement with new owners, and local word of mouth.

Maximum/Extra listings box

Among all 178 locations from 2017 through 2019, the fewest residential listings sold were at Fobes Hill in Snohomish County (21). The greatest number sold were at Sammamish (1,502). Each of these locations is represented by a single card. The difference in scale is partly accounted for by the methods for populating the farming tables and VP scores. However, there remains the matter of setting a ceiling on how many listings can be won in a single turn at smaller locations.17

A red maximum listings box resolves this by either setting a limit of one or two listings for locations with fewer than 50 sales during the three-year period, or by indicating “N/A” for locations with greater numbers of sales less than 500. For locations with still greater listing volumes,18 a green box is shown, allowing a follow-up draw for a second listing if the first listing opportunity is won. If the second draw indicates a mandatory event, that even is skipped, and the prospecting/event deck is reshuffled.

Because the solution to the geographic farming table is integrated with the computation of visibility point scores, the explanation of how these were computed will be combined in the later journal entry entitled “Visibility points: accumulation and scoring.”

Office locations and maintenance costs

As explained earlier, the original design was intended to model competition among different brokerage brands, and was to incorporate the opening of new offices in different locations over the course of the game. This proved impractical, as the opening and closing of offices is infrequent except for rapidly growing brokerages. Including other brands and new office planning would broaden the scope away from agents and agent operations, and how these benefit brand visibility.

However, the necessity of an office for mandatory recordkeeping, and its desirability for training, negotiations, and promotions, together imply resource concentration benefits of offices to agents operating nearby. Excluding the cost considerations of remote listings from the game would make it too easy for agents using geographic farming to operate in widely scattered locations in ways that few are able to do successfully in real life. (This is less of a problem for agents using sphere marketing, which is why their maintenance costs are fixed.)

A solution is for offices to be positioned at the beginning of the game, either historically according to a subject brand, or freely according to the players’ opening strategies. Subsequently, setting up geographic farming in any location incurs an initial promotion & cost recovery (P&CR) expenditure based on that location’s distance from the nearest local office, as well as a regular maintenance cost. (We will discuss P&CR at length in a later entry.)

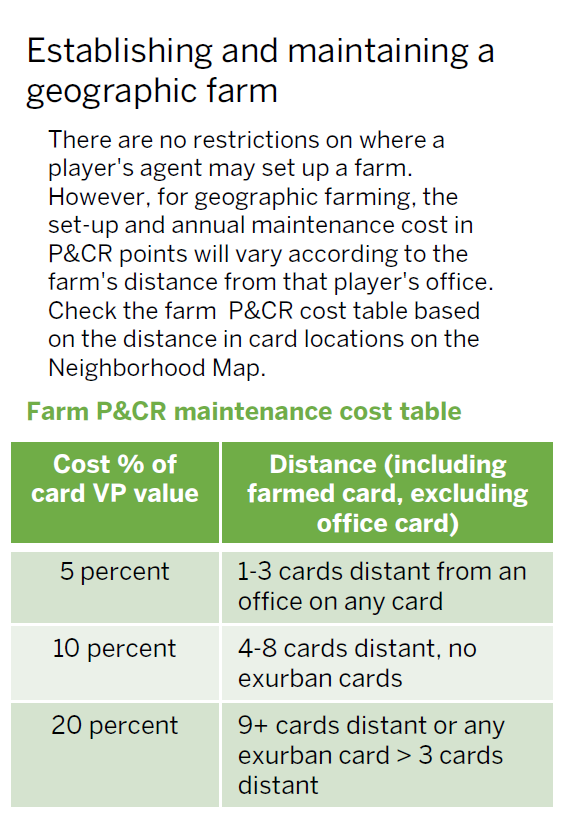

Establishing and maintaining a farm

There are no restrictions on where a player may set up an agent’s farm, although agents will be limited as to starting locations. Farms located on office cards are free. For geographic farming in more remote locations, the set-up and annual maintenance cost in P&CR points will vary according to the farm's distance from that player's office, according to the farm P&CR maintenance cost table.

Marketing spheres have no geographical place. However, the establishment of a marketing sphere does imply the execution of a social media and print strategy, travel and communications costs, social engagement, as well as other outreach efforts which together can impose a burden of time and money. Their maintenance costs are tentatively fixed at 10 P&CR points.

16Presented with an image selection from the location cards, game designer Fred Serval insightfully suggested that the photo on the card be enlarged to take the shape of a watermark on the card. The uncertain status of the game as a commercial or internal product leaves this question and others as to location photographs unresolved for now.

17Some players might ask why such locations are represented by location cards. Their lesser desirability as geographic farming locations is indicated by their comparatively lower visibility point values. However, they are adjacent to denser locations. E.g., Fobes Hill is adjacent to the City of Snohomish and Machias. A farm at either of these locations is presented with a three-percent chance of drawing a listing at Fobes Hill. (A farm at Snohomish gets another 1/2,000 chance of a Fobes Hill listing through exposure to the exurban listing location table.)

18Whether to remove the sold flag after fewer than five turns is a question to be resolved based on playtest results.

19There are only six of these: Bainbridge Island, Capitol Hill, Magnolia, Mercer Island, Queen Anne, and Sammamish.

Schedule of entries

- Spheres & Farms™ design and strategy journal: Introduction

- The agent and brokerage as real estate brands

- How price and place matter

- Visualization, testing, and learning

- Spheres & Farms™ game summary

- Game procedures and routines in the context of agency law and practice

- Game components; agent counters and cards

- Farming methods; market selection

- More about marketing spheres; the economic cycle track (ECT)

- Economic cycle effects on marketing spheres

- Location cards: the Spheres & Farms™ "game map"